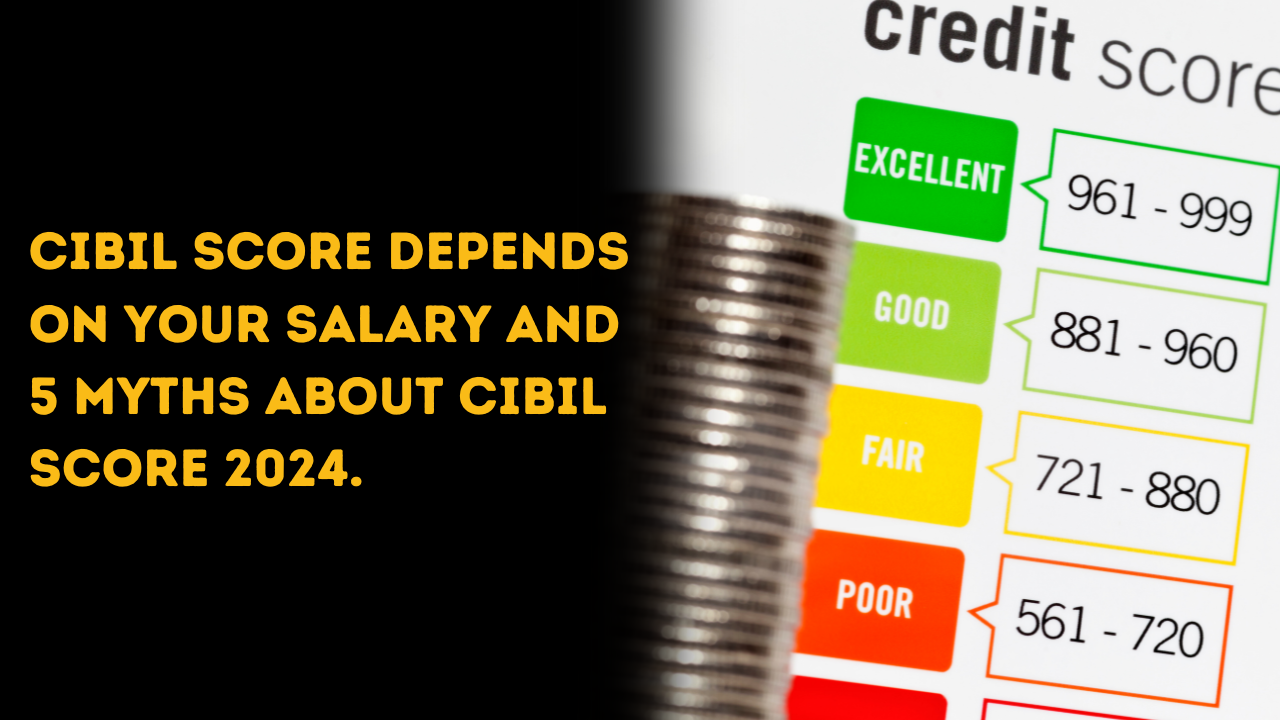

CIBIL score depends on your salary and 5 myths about CIBIL score.

21 Jun 2024 6 mins Personal Finance

There is a lot of information regarding credit scores and reports and at the same time, there is a lot of misinformation on the topic as well. Does my salary influence my credit score, whether checking the score has any influence, paying cash improves the score, and more and more! But is there any truth to it? Let's find out below and debunk some common credit card myths.

Myth #1: The more you earn, the better your credit/ CIBIL score will be

That is not true at all. A credit score assigns a score based on how your past credits and current loans are managed. It is not influenced by the salary you have in hand. It depends on your current EMIs and other factors such as your credit mix, loan inquiries, and payment history. With a good salary, you will have more money to spend. You won't miss payments if you have more disposable income (money you can spend freely). Hence your score will be sustained. Besides this indirect effect, there is no connection between the salary and credit/ CIBIL score.

Read more on the factors affecting the CIBIL score here

Myth #2: Checking the CIBIL score will reduce the credit score.

Does your CIBIL score reduce every time you check it? Let's see the truth of that.

There are two types of enquiries when pulling the CIBIL score/ CIBIL report. When you as an individual are using the authorised sites to access the report and score, it is called a soft inquiry. When lenders make an attempt to extract your score upon your inquiry for a new loan or credit card, this is called a hard inquiry. The CIBIL score is only affected when there are too many hard inquiries in a short time. Too many loan applications give the impression to lenders that you are moving towards a debt-driven life.

Checking your CIBIL score and report from time to time is essential to know your financial standing and what you can plan ahead. It also helps in correcting any mistakes in the report. Not sure how to correct your disputes in the CIBIL report? No worries, we got you here!!

Myth #3: CIBIL score is not the only credit score in India

This is true! Though credit and CIBIL scores are mainly used interchangeably, there are three other credit bureaus in India. They are Experian, Equifax and CRIF High Mark. All these bureaus collect and compile credit information from the lenders and banks. However, TransUnion CIBIL is the oldest and most widely used by lenders.

Myth #4: Settling your debt can improve your credit score

There is a difference between settling and closing your debt. In both these cases there are changes in the credit score.

Settling a debt occurs when the lender or the bank and the person who has taken come to a common amount to clear out the debt. This amount will be lower than what is owed back to the bank. Loan users sometimes choose this option when paying back the complete amount becomes difficult. But the side effect this action brings is that it will be marked as settled in the credit report and makes you short-handed in securing future loans.

Closing a debt means repaying the complete amount to the bank.

You can change the settled status to closed status by repaying the remaining amount and raising a dispute with CIBIL along with a non-objection certificate from the bank.

Additionally, closing your debt reduces your credit utilisation ratio, an important factor in measuring your CIBIL score. Since you are closing the loan, the credit available is reduced and the ratio increases. It is advisable to have 30% of the total available credit amount to be used.

Closing or settling the debt can also change your profile's credit mix and affect the report and score.

But as long as the above criterias are considered, paying off debt will improve your score.

Myth #5: Closing the old credit card can improve credit score

False. Closing an old credit card means you are closing your longest credit history. It reduces the average credit history of your transactions and can adversely affect your score. Keeping your old credit card, even if not in use, can help maintain the credit utilisation ratio under the optimum ratio of 30%. However, if it is challenging to manage the card, it is advisable to close it.

Myth #6: Debit card transactions add up to the credit score

The credit score is built based on the credit funds you have taken. The debit card is using your existing money from the bank. Almost similar to making a cash payment. Since you are not borrowing money, debit card transactions are not considered in the credit history or the score. Only the credit information is compiled and made to report by the credit bureaus.

In conclusion, your credit score depends mainly on the 4 factors: repayment history, credit mix, credit utilisation and hard enquiries. Your salary does not influence your credit score. Only hard enquiries from the lenders affect the drop in the score when you request loans and credit cards. Moreover, keeping yourself updated with the changes in your credit history is essential. Do not forget to correct any mistakes that may have crept into the report by raising disputes. Your old credit card and debt settlements impact your score differently. So weigh out and make informed decisions to avoid the myths and achieve your dreams.

Get a Personal Loan that fits your needs. Apply for loans from Rs 1000 to Rs 15 Lakhs with competitive rates.

Find the Perfect Credit Card for your spending habits. Explore top credit cards and maximize your rewards.

Author - Abhishek Sonawane

Abhishek Sonawane, an MBA graduate from the prestigious Indian Institute of Management Visakhapatnam(IIMV), brings over ten years of experience in the finance domain. His extensive background includes various roles in financial management and strategy, providing him with a comprehensive understanding of the financial landscape. Abhishek’s expertise and dedication to financial education make him an authoritative voice in personal finance, helping readers make informed financial decisions.