Gratuity is a benefit provided by an employer to an employee as a token of appreciation for their service to the company.

Gratuity Calculator

Gratuity Payable

{{$filters.formatCurrency(gratuity ) }}

What is Gratuity?

Gratuity is a lump sum amount provided by an employer to an employee as a token of appreciation for the services rendered over a period of time. It is typically paid when an employee retires, resigns, or in unfortunate circumstances like death or disability. Understanding how gratuity is calculated can help you plan your financial future better.

How to Use the Gratuity Calculator?

Using a gratuity calculator is simple. You need to input certain values like your last drawn salary and the number of years of service. The calculator will then use the gratuity formula to compute the amount you are entitled to receive.

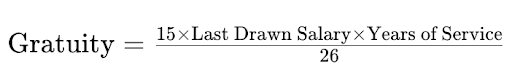

Gratuity Formula

The formula to calculate gratuity for employees covered under the Payment of Gratuity Act, 1972 is:

Where:

- Last Drawn Salary = Basic salary + Dearness allowance

- Years of Service = Number of years the employee has worked with the organization (if the employee has worked more than 6 months in a year, it is considered as a full year)

Example Calculation

| Details | Values |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Benefits of Gratuity

-

Financial Security

Gratuity provides financial security post-retirement or when switching jobs, helping employees manage their finances better during the transition period.

-

Recognition of Service

It acts as a token of appreciation from the employer, acknowledging the employee’s dedication and service to the company.

-

Tax Benefits

Gratuity received up to a certain limit is exempt from income tax, providing a tax-free lump sum amount to the employee

Who is Eligible for Gratuity?

Eligibility Criteria

-

Continuous Service:

The employee must have completed at least 5 years of continuous service with the same employer.

-

Retirement:

The employee should retire from service.

-

Resignation:

If an employee resigns after completing 5 years of service.

-

Death or Disability:

In the case of death or disability, the 5-year rule is relaxed, and gratuity is paid to the nominee or legal heir.

How is Gratuity Taxed?

Gratuity received by government employees is fully exempt from tax. For non-government employees, gratuity is exempt from tax up to a limit of ₹20 lakh. Any amount exceeding this limit is subject to tax as per the income tax slab of the individual.

Tax Exemption Table

| Employee Type | Tax Exemption |

|---|---|

| {{ row.column1 }} | {{ row.column2 }} |

Factors Affecting Gratuity Amount

-

Length of Service:

The number of years you have worked with your employer.

-

Last Drawn Salary:

Higher the salary, higher the gratuity amount.

-

Type of Employment:

Government vs. non-government employment.

Frequently asked questions

-

-

Gratuity is calculated using the formula: (15×Last Drawn Salary×Years of Service)/26(15 \times \text{Last Drawn Salary} \times \text{Years of Service}) / 26(15×Last Drawn Salary×Years of Service)/26.

-

Employees who have completed at least 5 years of continuous service with the same employer are eligible for gratuity.

-

Gratuity is tax-exempt up to ₹20 lakh for non-government employees. For government employees, it is fully exempt.

-

The maximum limit of gratuity is ₹20 lakh for non-government employees.

-

Gratuity can be denied if the employee has been terminated due to misconduct or fraud.

-

In case of death, gratuity is paid to the nominee or legal heir of the employee.

-

To claim gratuity, the employee must fill out Form I and submit it to the employer.

-

The Payment of Gratuity Act, 1972 is an Indian law that governs the payment of gratuity to employees engaged in factories, mines, oilfields, plantations, ports, railway companies, shops, or other establishments.

-

Gratuity is usually paid as a lump sum amount, but in some cases, it can be paid in installments as per the company policy.

Conclusion

Understanding gratuity and how it is calculated can significantly benefit employees in planning their financial future. Using a gratuity calculator can simplify this process, ensuring you receive the amount you are entitled to.

By comprehensively covering the essential aspects of gratuity, this webpage aims to provide valuable information and assist in making informed financial decisions.

Note:

Always consult with a financial advisor or HR professional for personalized advice related to gratuity and taxation-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.