A tool that helps you determine the maturity amount and interest earned on your fixed deposits

Fixed Deposit Calculator

Invested Amount

Est. Returns

Total Value

{{ $filters.formatCurrency(invested) }}

{{ $filters.formatCurrency(totalReturn) }}

{{ $filters.formatCurrency(totalAmount) }}

FD Returns Calculator - Calculate Maturity Amount and Yearly Interest

Accurately predict the FD maturity amount, interest earned (yearly and monthly) simplifying your investment decisions.

What is an FD Returns Calculator?

An FD returns calculator is an online tool designed to help you estimate the returns on your fixed deposits. By inputting key details such as the principal amount, interest rate, tenure, and compounding frequency, you can get a clear picture of your earnings at the end of the investment period.

Example of Fixed Deposit (FD) Return

Let's take an example to understand how returns from a Fixed Deposit (FD) work. Suppose you invest ₹50,000 in an FD with an annual interest rate of 6%, compounded annually, for a period of 5 years.

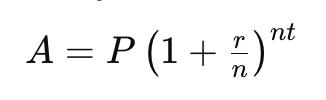

Compound Interest Formula

Where:

- A = the amount of money accumulated after n years, including interest.

- P = principal amount (₹50,000).

- r = annual interest rate (6% or 0.06).

- n = number of times interest is compounded per year (1 for annual compounding).

- t = the time the money is invested for (5 years).

| Year | Principal | Interest Earned | Total Amount |

|---|---|---|---|

| {{ row.col2 }} | {{ row.col2 }} | {{ row.col3 }} | {{ row.col4 }} |

Benefits of Using an FD Returns Calculator

-

Accurate Maturity Amount Prediction

A calculator provides precise estimates of your FD's maturity amount, allowing you to plan your finances better.

-

Simplifying Complex Calculations

Manual calculations of FD returns can be complex and prone to errors. An FD returns calculator automates this process, ensuring accuracy and saving time.

-

Enhancing Investment Decisions

With accurate predictions, you can compare different FD options and choose the one that best suits your financial goals.

How to Use an FD Returns Calculator

Step-by-Step Guide-

Enter the Principal Amount:

Input the initial amount you plan to invest in the FD.

-

Input the Interest Rate:

Enter the annual interest rate offered by the bank

-

Select the Tenure

Choose the duration for which you want to invest the money.

-

Choose the Compounding Frequency:

Select how often the interest is compounded (annually, semi-annually, quarterly, monthly).

Necessary Inputs

- Principal amount

- Interest rate

- Tenure

- Compounding frequency

Understanding the Results

-

Breakdown of the Results

The calculator will display the maturity amount, total interest earned, and a detailed breakdown of how the investment grows over time.

-

Real-World Examples

For instance, if you invest $10,000 at an annual interest rate of 6% for 5 years with quarterly compounding, the calculator will show you the total interest earned and the maturity amount at the end of the period.

Factors Affecting FD Returns Calculations

-

Principal Amount

The initial amount you invest significantly impacts the maturity amount. A higher principal results in greater returns.

-

Interest Rate

The annual interest rate determines how quickly your investment grows. Higher rates lead to higher returns.

-

Tenure of the Deposit

The length of time you keep your money in the FD affects the total interest earned. Longer tenures typically yield higher returns due to compounding.

-

Compounding Frequency

The frequency of compounding (annually, semi-annually, quarterly, monthly) affects how often interest is added to the principal. More frequent compounding results in higher returns.

Types of FD Returns Calculations

-

Simple Interest

Simple interest is calculated only on the principal amount. It is straightforward but typically yields lower returns compared to compound interest.

-

Compound Interest

Compound interest is calculated on the principal amount and the interest that accumulates on it over time. This method significantly increases the returns, especially over longer periods.

Common Mistakes to Avoid

-

Incorrect Data Input

Ensure all inputs are accurate to get precise results. Incorrect data can lead to misleading estimates.

-

Misunderstanding Compounding Frequency

Understand how different compounding frequencies affect your investment growth. More frequent compounding results in higher returns.

-

Ignoring Tax Implications

Interest earned on FDs is taxable. Consider the tax implications when calculating the net returns.

Interest earned on FDs is taxable. Consider the tax implications when calculating the net returns.

-

Choosing the Right Bank and Tenure

Different banks offer varying interest rates and terms. Research and select the bank and tenure that offer the best returns.

-

Understanding Interest Payout Options

Some FDs offer periodic interest payouts, while others reinvest the interest. Choose the option that aligns with your financial goals.

-

Reinvesting Interest Earned

Reinvesting the interest earned can significantly boost your returns, thanks to the power of compounding.

Comparison with Other Investment Tools

-

FD Returns Calculators vs. Savings Calculators

FD returns calculators are specifically designed for fixed deposits, providing more precise estimates compared to general savings calculators.

-

FD Returns Calculators vs. Mutual Fund Calculators

While FD returns calculators focus on guaranteed returns from fixed deposits, mutual fund calculators consider market risks and potential higher returns.

Real-Life Examples and Testimonials

User Experiences with FD Returns Calculators

Many users have found FD returns calculators to be invaluable tools for planning their investments. One user shared how the calculator helped them understand the benefits of compounding and choose the best FD scheme.

Future Trends in FD Returns Calculations

-

Integration with Digital Financial Tools

Future calculators may integrate with budgeting apps and financial planning tools, offering a more comprehensive view of your finances.

-

AI and Machine Learning Enhancements

AI technology could enhance calculators, providing more personalized and accurate predictions based on your financial history and goals.

Frequently asked questions

-

-

They provide highly accurate estimates when correct data is inputted.

-

Yes, FD returns calculators can be used for various FD schemes, including tax-saving FDs and senior citizen FDs.

-

Consider the principal amount, annual interest rate, tenure, and compounding frequency.

-

Choose the right bank and tenure, understand interest payout options, and consider reinvesting the interest earned.

Conclusion

-

Summary of Key Points

FD returns calculators are essential tools for anyone looking to invest in fixed deposits. They provide accurate predictions, simplify complex calculations, and help in setting realistic financial goals.

-

Encouragement to Use FD Returns Calculators

Start using an FD returns calculator today to understand the power of compounding and make informed investment decisions.

-

Get a Personal Loan that fits your needs. Apply for loans from

Rs 1,000 to Rs 15 Lakhs with Lowest Interest Rates.

-

Find the Perfect Credit Card for your spending habits. Explore

Top Credit Cards and maximize your rewards every month.