How to Check Income Tax Refund Status Online in 2024 - Updated

02 Aug 2024 4 mins Tax Planning

If you're eagerly awaiting your income tax refund, it's crucial to know how to check its status online using your PAN card. This guide will walk you through the steps, ensuring you can easily track your refund status.

Introduction to Income Tax Refund

Checking your income tax refund status online is a straightforward process that can be completed using your PAN card. This method saves you time and effort, making it convenient to stay updated on your refund.

Why Check Your Income Tax Refund Status?

Financial Planning

Knowing when you'll receive your refund can help in managing your finances better.

Avoiding Delays

Ensures that there are no discrepancies or issues causing delays in your refund.

Peace of Mind:

Provides reassurance that your tax return is being processed correctly.

Step-by-Step Guide to Check Income Tax Refund Status

1. Visit the Income Tax e-Filing Portal

First, go to the official Income Tax e-Filing website: Income Tax e-Filing Portal

2. Log in to Your Account

- Click on the 'Login Here' button if you are a registered user.

- Enter your PAN, password, and Captcha code, then click 'Login.'

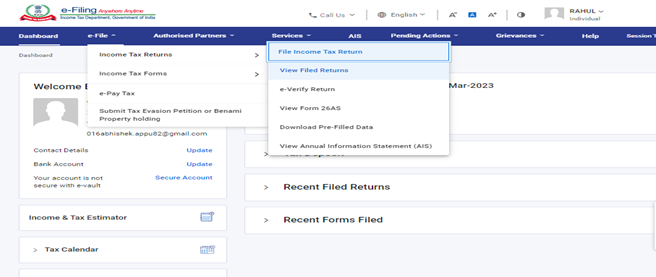

3. Navigate to 'View Returns/Forms'

Once logged in, hover over the 'My Account' tab and select 'View Returns/Forms' from the drop-down menu.

4. Select the Appropriate Option

- Choose 'Income Tax Returns' from the drop-down menu.

- Select the relevant assessment year and click on 'Submit.'

5. Check the Refund Status

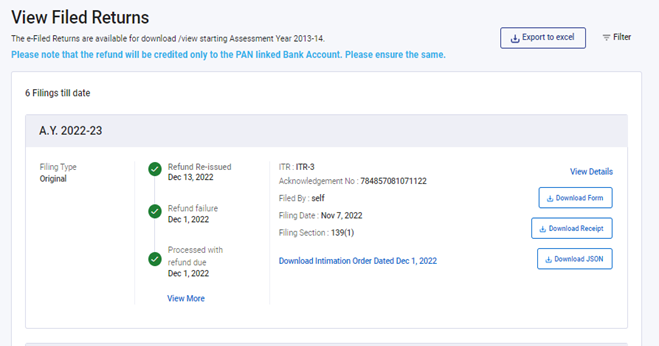

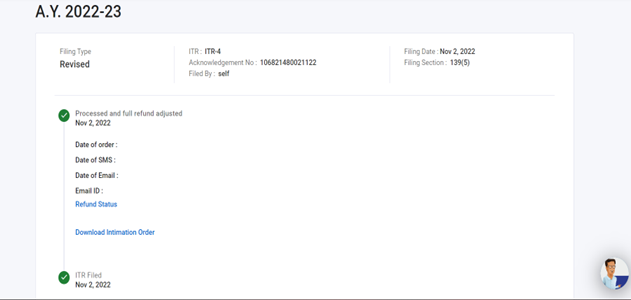

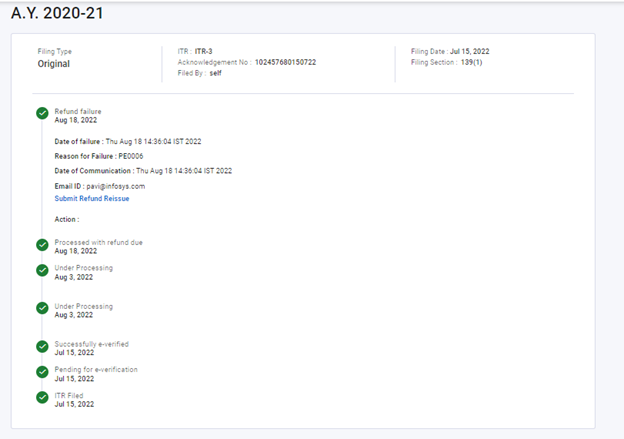

- On the next page, you'll see details of your filed returns. Click on the acknowledgment number for the relevant return to view the status.

- The status will be displayed on the screen, showing whether your refund is processed, pending, or any other status.

Status 1: When refund is issued:

Status 2: When refund is partially adjusted:

Status 3: When full refund adjusted:

Status 4: When refund is failed:

Alternative Method: Using TIN NSDL Website

1. Visit the TIN NSDL Website

Go to the TIN NSDL website: TIN NSDL

2. Enter Your Details

- Enter your PAN, the assessment year, and the Captcha code.

- Click on 'Submit.'

3. View Refund Status

Your refund status will be displayed on the screen, providing information on the current status and any actions required.

Common Issues and Solutions

Incorrect PAN or Assessment Year:

Ensure you enter the correct details to avoid errors.

Mismatch in Bank Details:

Verify that your bank details are accurate and updated in your e-Filing profile.

Pending Documentation

Check if any additional documentation is required by the Income Tax Department.

Frequently Asked Questions (FAQs)

Q1: How long does it take to receive an income tax refund?

Generally, it takes 20-45 days after the ITR processing for the refund to be credited, but it can vary based on several factors.

Q2: What should I do if there is a delay in my refund?

Check the status online, and if it's pending for long, contact the CPC of the Income Tax Department or raise a grievance online.

Q3: Can I check my refund status without logging in to the e-Filing portal?

Yes, you can use the TIN NSDL website for checking the status without logging in to the e-Filing portal.

Q4: What details are required to check the refund status on the TIN NSDL website?

You need your PAN, assessment year, and Captcha code to check the status on the TIN NSDL website.

Q5: Is it safe to check my refund status online?

Yes, both the Income Tax e-Filing portal and the TIN NSDL website are secure and safe for checking your refund status.

Conclusion

Checking your income tax refund status online using your PAN card is a simple and effective way to stay updated. By following the steps outlined above, you can easily monitor the progress of your refund and take necessary actions if required.