What Are The Different Types of Mutual Funds in India?

02 Sep 2024 7 mins Mutual Funds

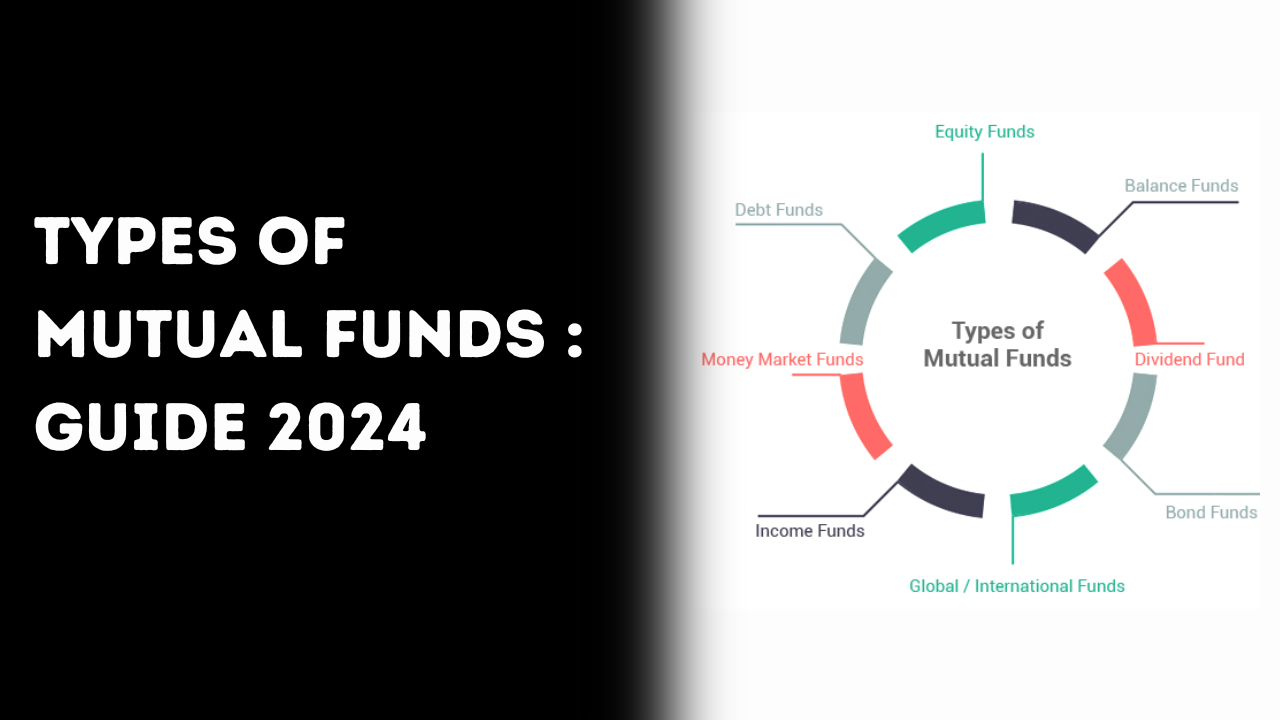

Investing in mutual funds is a popular way to grow your wealth, but with so many options available, it can be confusing to know where to start. Whether you're a beginner or an experienced investor, understanding the different types of mutual funds is crucial.

In this blog, we'll explore the various types of mutual funds in India, breaking them down based on structure, investment objectives, and asset classes. Let's dive in!

What Are the Different Types of Mutual Funds in India?

Mutual funds in India can be broadly classified into several categories. Here are the main types you should know about, along with examples:

1. Equity Mutual Funds

Equity mutual funds invest primarily in stocks. They are ideal for investors looking for long-term capital appreciation. These funds can be further categorized based on market capitalization (large-cap, mid-cap, small-cap) or investment strategy (growth, value, or blend).

Example: SBI Bluechip Fund (Large-Cap Fund)

2. Debt Mutual Funds

Debt mutual funds invest in fixed-income securities like bonds, government securities, and money market instruments. These are suitable for investors seeking regular income and lower risk compared to equity funds. Types of debt mutual funds include liquid funds, short-term funds, and corporate bond funds.

Example: HDFC Short Term Debt Fund (Short-Term Debt Fund)

3. Hybrid Mutual Funds

Hybrid mutual funds, also known as balanced funds, invest in a mix of equity and debt. They offer a balanced approach, providing both growth and income. Depending on the allocation, hybrid funds can be equity-oriented or debt-oriented.

Example: ICICI Prudential Equity & Debt Fund (Equity-Oriented Hybrid Fund)

4. Index Funds

Index funds are a type of equity mutual fund that mimics a specific index, like the Nifty 50 or Sensex. These funds aim to replicate the performance of the index by holding the same stocks in the same proportion. They are ideal for investors who want to invest in the market with minimal active management.

Example: UTI Nifty 50 Index Fund

5. Sectoral/Thematic Funds

Sectoral or thematic funds focus on specific sectors like technology, healthcare, or energy, or themes like ESG (Environmental, Social, Governance). These funds carry higher risk but can offer high returns if the sector or theme performs well.

Example: Franklin India Technology Fund (Sectoral Fund - Technology)

What Are the Types of Mutual Funds Based on Structure?

Mutual funds can also be categorized based on their structure:

1. Open-Ended Funds

Open-ended funds are the most common type of mutual funds. They don't have a fixed maturity date, and you can buy or sell units at any time based on the current NAV (Net Asset Value). These funds offer high liquidity.

Example: Mirae Asset Large Cap Fund

2. Close-Ended Funds

Close-ended funds have a fixed maturity period, usually ranging from 3 to 7 years. Investors can buy units only during the initial offer period and can sell them on the stock exchange where they are listed.

Example: Sundaram Select Micro Cap Fund - Series X (Close-Ended Fund)

3. Interval Funds

Interval funds combine features of both open-ended and close-ended funds. They allow investors to buy or sell units at specific intervals, as stated in the scheme.

Example: ICICI Prudential Interval Fund - Series VI

How Many Types of Mutual Funds Are There?

The number of mutual fund types can vary depending on how they are categorized. However, broadly speaking, there are:

- Equity Funds

- Debt Funds

- Hybrid Funds

- Index Funds

- Sectoral/Thematic Funds

Each of these categories can be further divided based on specific investment objectives or asset classes.

What Are the Types of Equity Mutual Funds?

Equity mutual funds can be classified into several types based on market capitalization, investment style, and sector focus:

1. Large-Cap Funds

Large-cap funds invest in companies with large market capitalizations. These companies are usually well-established and carry lower risk compared to mid-cap or small-cap funds.

Example: Axis Bluechip Fund

2. Mid-Cap Funds

Mid-cap funds invest in medium-sized companies. These funds offer a balance between risk and return, as mid-cap companies have higher growth potential than large-cap companies but are less stable.

Example: DSP Midcap Fund

3. Small-Cap Funds

Small-cap funds invest in small-sized companies. These funds are highly volatile but can offer significant returns if the companies perform well.

Example: HDFC Small Cap Fund

4. Multi-Cap Funds

Multi-cap funds invest across companies of different market capitalizations. This diversification helps in balancing risk and reward.

Example: Kotak Flexicap Fund

5. Sectoral/Thematic Funds

As mentioned earlier, these funds focus on specific sectors or themes, offering concentrated exposure to certain industries or investment trends.

Example: ICICI Prudential Banking & Financial Services Fund (Sectoral Fund - Banking)

What Are the Types of Debt Mutual Funds?

Debt mutual funds can be categorized based on the duration of the investments and the type of debt securities they invest in:

1. Liquid Funds

Liquid funds invest in short-term instruments like treasury bills and certificates of deposit with maturities up to 91 days. They offer high liquidity and are considered safe.

Example: Aditya Birla Sun Life Liquid Fund

2. Short-Term Funds

Short-term debt funds invest in securities with a maturity period of 1 to 3 years. They are suitable for investors with a short investment horizon looking for stable returns.

Example: ICICI Prudential Short Term Fund

3. Corporate Bond Funds

Corporate bond funds invest in high-rated corporate bonds. These funds are ideal for investors seeking higher returns than government securities with moderate risk.

Example: HDFC Corporate Bond Fund

4. Gilt Funds

Gilt funds invest in government securities. They carry minimal credit risk and are suitable for risk-averse investors.

Example: SBI Magnum Gilt Fund

5. Dynamic Bond Funds

Dynamic bond funds adjust their portfolio based on interest rate movements, investing in bonds of varying maturities. These funds aim to maximize returns in different interest rate scenarios.

Example: Kotak Dynamic Bond Fund

FAQs

Q1: What is the safest type of mutual fund?

Debt mutual funds, especially liquid and gilt funds, are considered among the safest as they invest in government securities and short-term instruments.

Q2: Can I lose money in mutual funds?

Yes, mutual funds are subject to market risks, and there is a possibility of losing money, especially in equity and sectoral funds.

Q3: How long should I invest in mutual funds?

The investment duration depends on your financial goals. For equity funds, a longer horizon (5-7 years) is recommended, while debt funds can be for shorter periods (1-3 years).

Q4: Are mutual funds better than fixed deposits?

Mutual funds generally offer higher returns than fixed deposits but come with higher risk. Fixed deposits are safer with guaranteed returns.

Q5: What is the minimum amount required to invest in mutual funds?

You can start investing in mutual funds with as little as ₹500 per month through SIP (Systematic Investment Plan).

Investing in mutual funds is a versatile way to meet your financial goals, whether you're looking for growth, income, or a balanced approach. By understanding the different types of mutual funds available, you can make informed decisions that align with your investment objectives.

Remember, while mutual funds offer potential for good returns, it's essential to assess your risk tolerance and investment horizon before diving in. Happy investing!