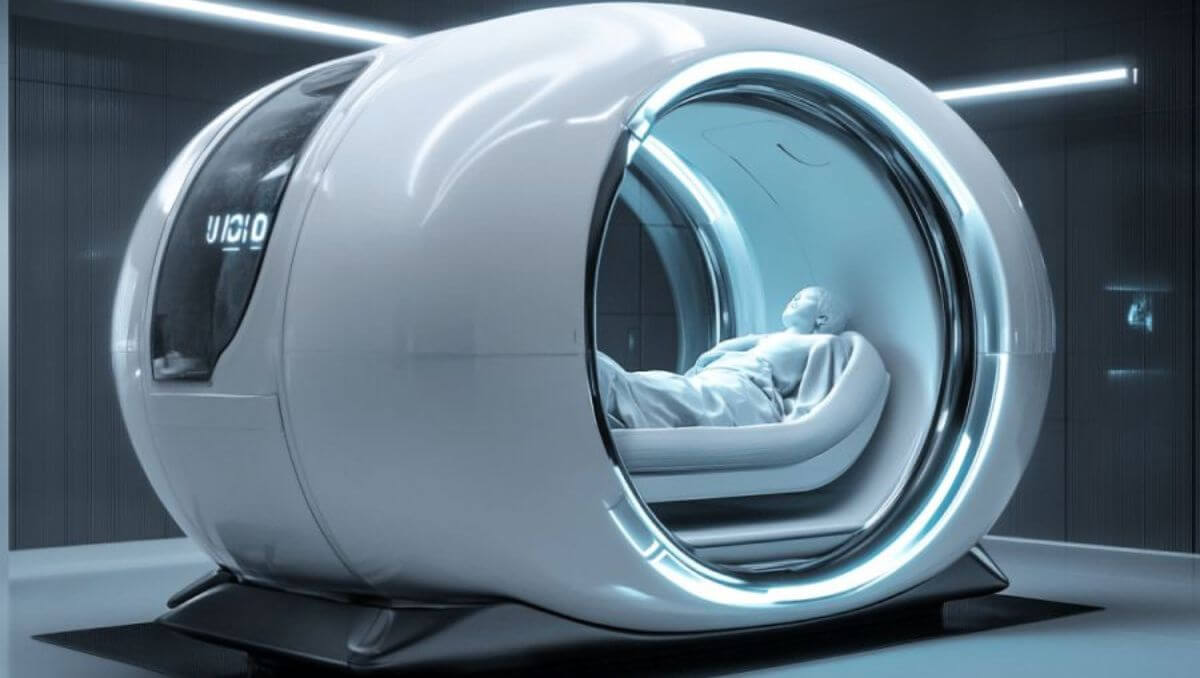

Japan Unveils AI-Powered ‘Human Washing Machine’ for a Spa-Like Experience

A Japanese company, Science Co., has introduced the revolutionary 'Mirai Ningen Sentakuki,' or "human washing machine of the future," combining spa relaxation with cutting-edge AI. This 15-minute pod bath uses warm water infused with microbubbles, commonly used for cleaning delicate electronics, to cleanse skin without soap. Equipped with mood-detecting electrodes, the pod adjusts water temperature and plays calming visuals to enhance relaxation. Inspired by a 1970 concept by Sanyo Electric