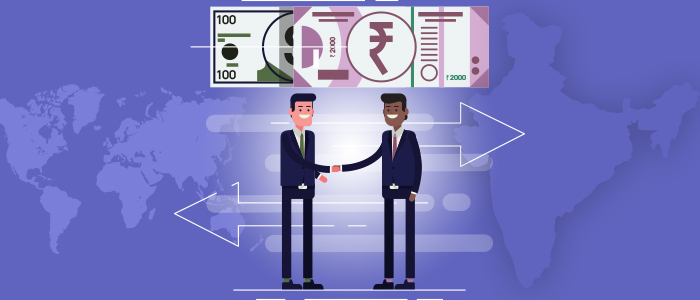

FPIs Withdraw Rs 6,300 Cr from Indian Equities in April Amid US Bond Yield Surge

Foreign investors pulled out Rs 6,300 crore from Indian equities in April due to concerns over changes in India's tax treaty with Mauritius and a rise in US bond yields, following substantial investments in March and February. The sustained increase in US bond yields, reaching around 4.7%, attracted foreign investors away from emerging markets. While commodity price surges and US retail inflation affected the outlook, domestic institutional investors absorbed FPI selling, mitigating its impact. Additionally, FPIs withdrew Rs 10,640 crore from the debt market during this period.