Top 5 Best Reward Credit Cards in India for 2026

23 Jan 2026 9 mins Credit Cards

In an increasingly digital and consumer-driven economy, credit cards have evolved from mere payment tools to essential financial instruments that can offer substantial rewards. Selecting the right credit card can lead to significant savings and perks that enhance your lifestyle. With numerous options available, it can be challenging to identify which cards provide the best value for your spending habits. In this article, we will delve into the best credit cards in India, focusing on the top five reward credit cards that offer the most appealing benefits. By the end of this article, you’ll be equipped with insights on how to redeem HDFC credit card reward points, ICICI credit card reward points, SBI credit card reward points, and more.

Understanding Reward Credit Cards

Reward credit cards are designed to incentivize cardholders by offering points or cashback on purchases. These rewards can be redeemed for various benefits such as travel bookings, merchandise, or even cashback. The value of these cards is not just in the rewards they offer but also in how easily those rewards can be earned and redeemed. For example, the HDFC credit card reward points system allows users to accumulate points for every transaction, making it easier to earn rewards quickly.

Why Choose a Reward Credit Card?

Maximize Spending: Earn points on everyday purchases, such as groceries, utilities, and dining. For instance, using a credit card for monthly household expenses can accumulate significant points over time.

Flexibility: Redeem rewards in various ways, from travel to shopping. Many cards allow you to redeem points for gift vouchers, merchandise, or even convert them to air miles, providing versatility in how you use your rewards.

Exclusive Offers: Access to special discounts and deals. Credit card companies often partner with retailers and service providers to offer exclusive discounts that can enhance your overall savings.

According to a recent report by the Reserve Bank of India (RBI), the credit card market in India has been growing at over 20% annually, indicating a rising trend towards utilizing credit cards for day-to-day transactions. This growth reflects a shift in consumer behavior, where users are increasingly looking for financial products that offer tangible benefits. In fact, the total credit card outstanding amount reached approximately ₹1.5 trillion in 2023, showcasing the increasing reliance on credit for consumer spending.

Key Features of Reward Credit Cards

When considering a reward credit card, it’s essential to look at key features that can enhance your financial experience:

Reward Points Structure: Understand how points are earned (e.g., 1 point for every ₹100 spent). Some cards offer accelerated points on specific categories like travel or dining, which can significantly enhance your rewards.

Redemption Options: Review how and where you can redeem your points. Some cards allow for direct booking of flights or hotels, while others may require you to convert points into vouchers.

Annual Fees: Be aware of any fees associated with maintaining the card. While some cards with high fees offer substantial rewards, ensure that your spending justifies the cost.

Bonus Offers: Look for cards that provide sign-up bonuses or promotional offers. For example, some cards offer extra points if you spend a certain amount within the first few months of getting the card.

Top 5 Reward Credit Cards in India

1. HDFC Regalia Credit Card

The HDFC Regalia Credit Card is a premium offering that provides extensive benefits. With a reward points system that allows you to earn 4 reward points for every ₹150 spent, it's an excellent choice for frequent shoppers and travelers. The card also comes with complimentary airport lounge access, travel insurance, and an annual fee waiver on spending above ₹3 lakh. Additionally, the Regalia card offers exclusive dining experiences at luxury restaurants, which can be a great perk for food enthusiasts.

2. ICICI Platinum Credit Card

The ICICI Platinum Credit Card is designed for those who prefer cashback over points. Cardholders earn 2% cashback on all online spends and 1% on offline transactions. The card also offers a range of discounts on dining and entertainment, making it ideal for social spenders. A unique feature is its ability to enhance cashback on select merchant categories during promotional periods, providing additional savings for users who strategically plan their spending.

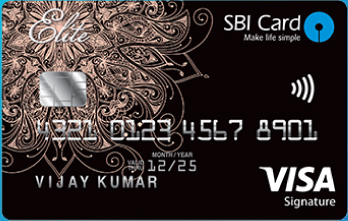

3. SBI Card Elite

The SBI Card Elite is another excellent choice, especially for travelers. It offers 5 reward points per ₹100 spent on dining, groceries, and international spends. Additionally, cardholders enjoy complimentary access to lounges and an annual fee waiver on spending above ₹7.5 lakh. The card also includes features such as travel insurance and concierge services, which can greatly enhance the travel experience for frequent flyers.

4. American Express Membership Rewards Credit Card

The American Express Membership Rewards Credit Card is ideal for those who value flexibility in reward redemption. With 1 point for every ₹50 spent, these points can be redeemed for a myriad of options, including flights, hotel stays, and shopping vouchers. The card also offers exclusive dining benefits and access to premium events. Notably, Membership Rewards points can be transferred to various airline frequent flyer programs, providing an opportunity for savvy travelers to maximize their rewards.

5. Axis Bank Flipkart Credit Card

The Axis Bank Flipkart Credit Card is perfect for online shoppers. It offers 5% cashback on Flipkart and Myntra purchases, along with 1.5% on all other transactions. The card is designed to maximize online shopping benefits while also providing attractive offers on travel and lifestyle purchases. Additionally, users can benefit from early access to sales and exclusive deals on Flipkart, enhancing the overall shopping experience.

How to Redeem Reward Points Effectively

Understanding how to redeem your reward points is crucial to maximizing the benefits of your credit card. Here’s how to redeem rewards for the HDFC credit card, ICICI credit card, SBI credit card, and American Express cards:

HDFC Credit Card Reward Points Redemption

HDFC allows users to redeem points through its online portal. To redeem:

Log in to your HDFC net banking account.

Navigate to the 'Rewards' section.

Select the option to redeem points for various offers or products.

Choose your desired redemption method, whether for travel bookings, merchandise, or cashback.

ICICI Credit Card Reward Points Redemption

ICICI also provides an online platform for redemption. Steps include:

Access the ICICI internet banking portal.

Go to the 'Rewards' section.

Choose from available redemption options, including vouchers and cashback.

Follow the prompts to finalize your redemption.

SBI Credit Card Reward Points Redemption

SBI cardholders can redeem points via the YONO app or the SBI Card website. The process involves:

Log in to the YONO app or SBI Card portal.

Select 'Rewards' from the menu.

Follow prompts to redeem points for products or services.

Review the available options and confirm your selection to complete the redemption.

American Express Rewards Credit Card Redemption

American Express offers a straightforward redemption process. Simply:

Log in to your American Express account online.

Navigate to the 'Rewards' section.

Select your preferred redemption option, whether for travel, shopping, or statement credits.

Confirm your choice and complete the redemption process.

Real-Life Examples of Reward Credit Cards in Action

Understanding how reward credit cards work in real life can enhance your decision-making. For instance, consider a frequent traveler who uses an HDFC Regalia Credit Card for all travel-related expenses. By accumulating points over time, they can redeem them for free flights or hotel stays, significantly reducing travel costs. For example, a traveler who spends ₹1,50,000 annually on travel can earn approximately 4,000 reward points, which can be redeemed for a domestic flight worth ₹5,000.

Latest Trends in Reward Credit Cards

According to industry reports, the trend of rewarding customers for their loyalty is gaining traction. Many credit card issuers are now offering personalized rewards based on user spending patterns. This means that as a customer, you can tailor your credit card experience to match your lifestyle, making it easier than ever to maximize benefits. Additionally, the integration of technology has led to the rise of mobile wallets and contactless payments, which are often linked to reward earning potential. A survey conducted by the Credit Card Association of India indicated that 60% of cardholders prefer rewards tailored to their spending habits, emphasizing the importance of personalization in the competitive credit card market.

FAQs

What are the best reward credit cards in India?

The best reward credit cards in India include the HDFC Regalia, ICICI Platinum, SBI Card Elite, American Express Membership Rewards, and Axis Bank Flipkart Credit Card.

How do I redeem my HDFC credit card reward points?

You can redeem HDFC credit card reward points through the HDFC net banking portal or mobile app by selecting the 'Rewards' section and following the prompts for your desired redemption.

Are there any fees associated with reward credit cards?

Yes, most reward credit cards have an annual fee, which may be waived based on your spending patterns. Some premium cards may also have higher fees but offer more substantial rewards.

What is the average earning rate for reward points?

Typically, reward cards offer between 1 to 5 points per ₹100 spent, depending on the card and spending category. Special promotions can temporarily boost these rates, providing additional opportunities for accumulation.

Can I convert my credit card reward points to cash?

Many credit cards allow you to redeem points for cashback or statement credits, though this option varies by issuer. It's advisable to check the specific terms for each card to understand the redemption process.

Conclusion

Reward credit cards provide significant benefits through points and cashback, enhancing your overall purchasing power.

Choosing the right card can lead to substantial savings and perks tailored to your lifestyle.

Understanding how to redeem points is essential for maximizing benefits and ensuring you get the most value from your spending.

Find the Best Mutual Funds for your every investment goal. Explore top mutual funds and start your SIP Today!

Find the Best Credit Card for your spending habits. Explore top credit cards and maximize your rewards.

Get a Personal Loan that fits your needs. Apply for loans from Rs 1000 to Rs 15 Lakhs with competitive rates.

Author - Abhishek Sonawane

Abhishek Sonawane, an MBA graduate from the prestigious Indian Institute of Management Visakhapatnam (IIMV), brings over ten years of experience in the finance domain. His extensive background includes various roles in financial management and strategy, providing him with a comprehensive understanding of the financial landscape. Abhishek’s expertise and dedication to financial education make him an authoritative voice in personal finance, helping readers make informed financial decisions.