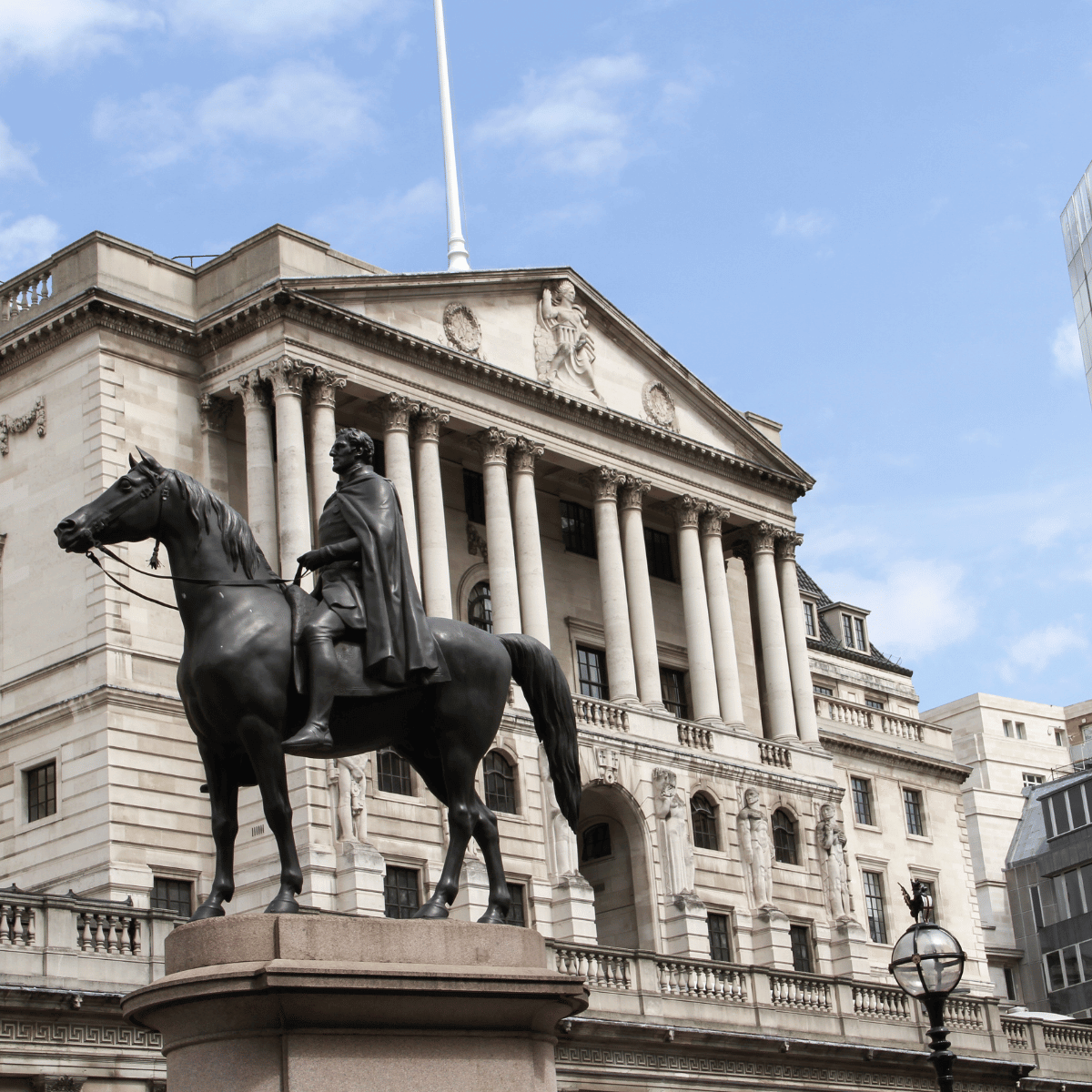

Bank of England Lowers Interest Rate to 4.75% as Inflation Drops Below Target

The Bank of England has reduced its main interest rate by 0.25% to 4.75%, marking its second cut in three months. This decision follows a steady drop in inflation, which now sits at 1.7%—below the bank's target of 2% and the lowest since April 2021. Central banks worldwide, including the US Federal Reserve, are also cutting rates in response to easing inflation pressures after years of elevated borrowing costs driven by supply chain issues and rising energy costs from the Ukraine conflict. However, with recent tax hikes in the UK’s new budget, economists warn that inflationary pressures may rise again next year, potentially limiting further rate cuts.