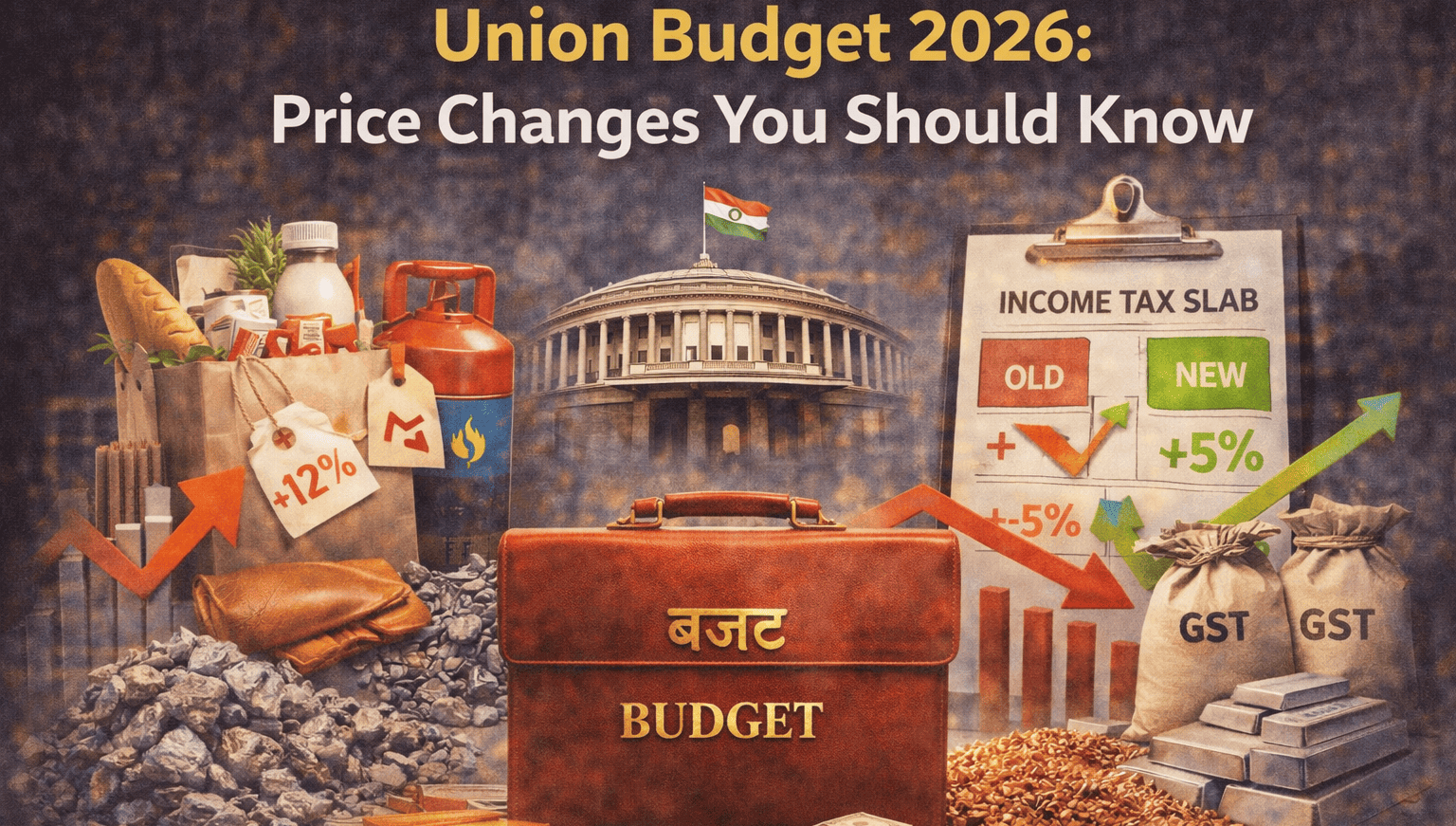

Budget 2026: Simplified Tax Filing and Reduced TCS

Budget 2026 has introduced significant changes aimed at simplifying tax compliance for individual taxpayers in India. One of the major highlights is the new provision that allows investors holding securities of multiple companies to submit only one form — either form 15G or form 15H — to the depository, rather than having to file with each individual company. This change is expected to streamline the tax filing process and reduce the paperwork burden on taxpayers.

Another noteworthy change in the Budget is the reduction of the tax collected at source (TCS) on foreign tour packages. Previously, TCS rates ranged from 5% to as high as 20%, depending on the cost of the package. However, the new budget proposes a uniform TCS rate of just 2%, regardless of the amount spent on foreign travel. This reduction is expected to encourage more Indians to explore international travel, making it more affordable and accessible.

The changes proposed in Budget 2026 reflect a growing recognition of the need to ease the financial burdens on taxpayers and promote transparency in tax compliance. By simplifying forms and reducing the TCS, the government aims to create a more taxpayer-friendly environment, which could ultimately lead to increased compliance and revenue for the state.

Overall, Budget 2026 is a step in the right direction for individual taxpayers in India. The simplification of the tax filing process and the reduction in TCS on foreign travel packages are measures that can potentially benefit a large segment of the population. As citizens embrace these changes, it’s likely to foster a more positive relationship between taxpayers and the government, paving the way for a more efficient tax system in the future.