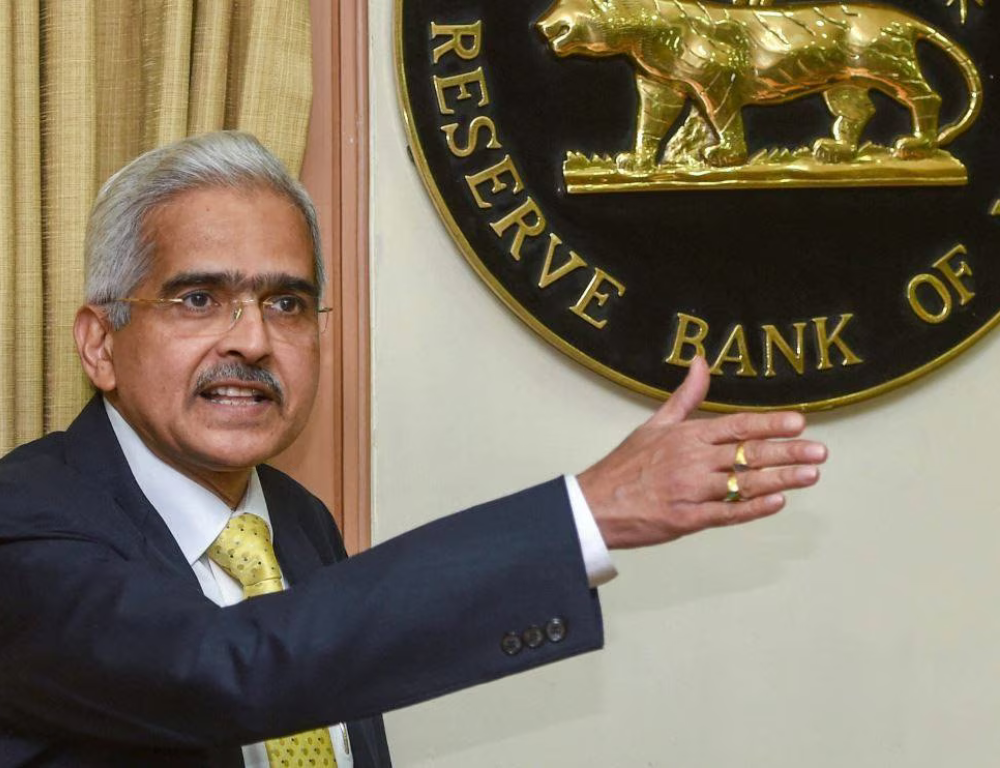

RBI Introduces New Rules for Bank Loans to Individuals and MSMEs

The Reserve Bank of India (RBI) has implemented fresh regulations concerning bank loans for individuals and Micro, Small, and Medium Enterprises (MSMEs). These rules aim to streamline lending processes and enhance financial accessibility.

For individuals, banks are now required to provide clear, transparent communication regarding loan terms and conditions. Additionally, banks must conduct thorough credit assessments to ensure borrowers' ability to repay loans. For MSMEs, the RBI mandates banks to adopt a borrower-friendly approach, offering flexibility and tailored financial solutions to support their growth.