What to expect in Union Budget 2026?

31 Jan 2026 7 mins Tax Planning

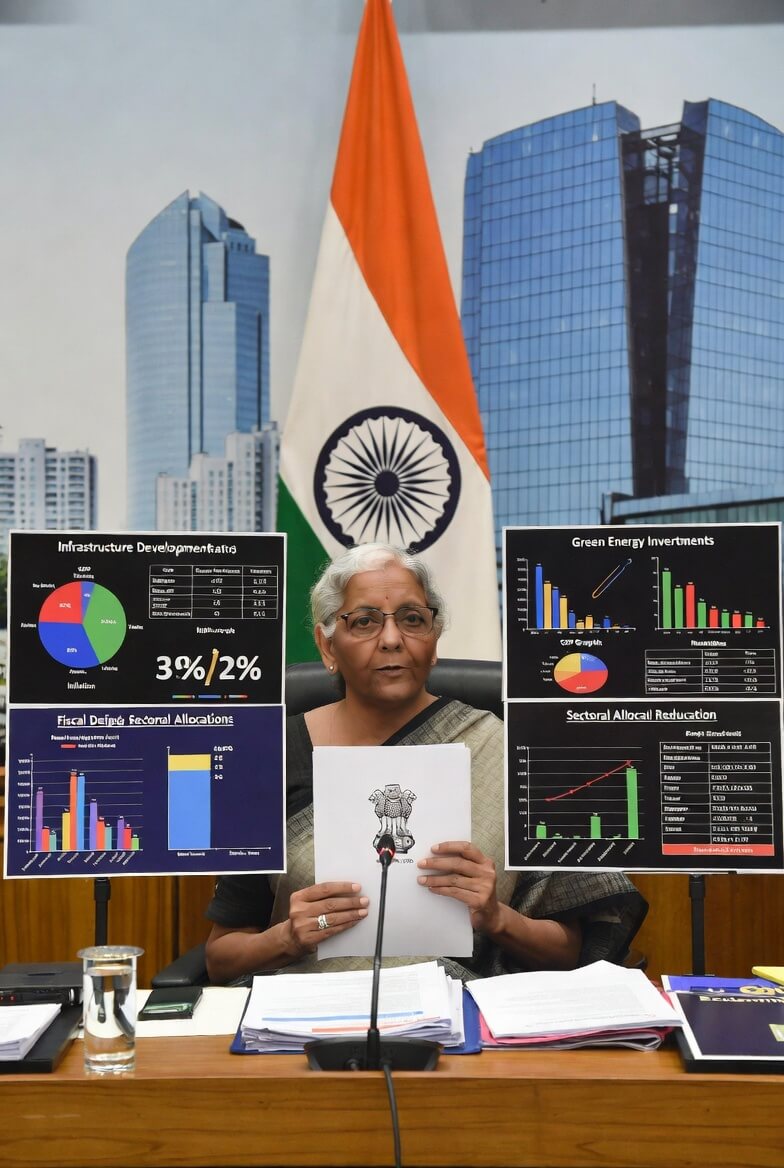

As India prepares for the Union Budget 2026-27 on February 1, 2026, presented by Finance Minister Nirmala Sitharaman, excitement is building across sectors. This budget arrives at a crucial moment for the world's fastest-growing major economy, with FY27 GDP growth projected at 6.8-7.2%, historically low inflation (~1.7-2%), and strong domestic demand. Despite global risks like US tariffs, geopolitical tensions, and a potential severe crisis, the focus remains on balancing fiscal discipline with pro-growth measures. This guide covers the top Budget 2026 expectations, from tax changes to sectoral boosts, based on the Economic Survey 2025-26 and expert views.

The Union Budget 2026 aims to strengthen economic resilience amid external challenges. The Economic Survey projects 7.4% GDP growth for FY26 and 6.8-7.2% for FY27, fueled by consumer spending, infrastructure, and reforms. Fiscal targets include lowering the deficit to ~4.3-4.4% of GDP in FY27 (from 4.8% in FY26) to ensure debt sustainability and stability.

Experts expect continued emphasis on capital expenditure (capex), possibly rising to ₹11-12 lakh crore to attract private investment and support growth. This supports India's goal of reaching a $5 trillion economy by 2027-28 (after crossing $4 trillion). Revenue spending, including subsidies, may be tightened to preserve fiscal prudence without cutting key schemes like PM-KISAN or MGNREGA.

Income Tax Slab Changes and Personal Finance Reforms

One of the most searched Budget 2026 expectations revolves around income tax relief, especially for the salaried middle class grappling with rising living costs. Under the new tax regime, taxpayers hope for an increase in the standard deduction from Rs 75,000 to Rs 1-1.25 lakh, potentially making incomes up to Rs 13 lakh tax-free. Experts suggest minor tweaks like shifting the 30% slab to incomes above Rs 40 lakh and reviving deductions for home loans (up to Rs 4 lakh interest) and education loans.

Senior citizens may get special concessions, such as higher exemptions or separate slabs, to address healthcare expenses. A groundbreaking proposal is optional joint tax filing for married couples, allowing utilization of a non-earning spouse's exemption limit, similar to systems in the US and Germany. This could significantly reduce the tax burden for single-income families.

For investors, there's buzz around capital gains tax reforms. Demands include abolishing or reducing Long-Term Capital Gains (LTCG) tax from 12.5% to 5-10%, slashing Short-Term Capital Gains (STCG) from 20% to 10%, and restoring indexation benefits to account for inflation. Securities Transaction Tax (STT) abolition is a long-shot but popular wish, potentially attracting FII inflows of Rs 4-5 lakh crore. Crypto traders, stung by losses yet taxed under current rules, seek rationalization like lower TDS rates or loss offsets.

Overall, while drastic income tax slab changes are unlikely, targeted reliefs could boost consumption and savings, with a focus on simplifying compliance under the new Income Tax Act 2025.

Comparison of Expected Tax Changes

Tax Type | Current Rate | Expected Change |

|---|---|---|

Individual Income Tax | Up to ₹2.5 lakh (0%) | Increase to ₹3 lakh (0%) |

Corporate Tax | 25% | Potential incentives for green technology |

GST Rates | Varies by product | Possible simplification and adjustments |

Sectoral Allocations: Boosting Infrastructure, Manufacturing, and Green Energy

Budget 2026 expectations highlight a sectoral push to enhance competitiveness and self-reliance. Infrastructure remains a cornerstone, with capex continuity for roads, railways, ports, and urban development. Railways could see allocations for high-speed corridors and modernization, benefiting stocks like IRCTC and RVNL. Defence, aiming for $125 billion spending, may get 10-20% hikes for indigenous manufacturing and exports.

Manufacturing and MSMEs are in the spotlight, with incentives for labour-intensive sectors like textiles, electronics, and autos. Expectations include higher depreciation allowances, credit guarantees up to Rs 10 crore, and GST rationalization (e.g., reducing 12% slab to 5-8%). The auto sector hopes for EV subsidies and tax reliefs to revive demand.

Green energy and renewables will likely see boosted funding for solar, wind, grid storage, and industrial decarbonization, aligning with India's net-zero goals. AI, robotics, and digital infrastructure could receive tax incentives and R&D support, fostering innovation.

Agriculture expects measures for food security, including PM-KISAN hikes from Rs 6,000 to Rs 12,000 annually, MSP increases, and investments in irrigation, cold chains, and crop diversification for pulses and oilseeds. Education and skilling may get 6% of GDP allocation, with expansions in IITs, IIMs, and skill courses.

Healthcare seeks policy support for rural expansion and cashless insurance for the middle class, while real estate anticipates stamp duty cuts and affordable housing limits raised to Rs 75 lakh.

Trade, Exports, and Global Integration

With the India-EU Free Trade Agreement (FTA) finalized, Budget 2026 is poised to capitalize on this milestone. Expectations include customs duty tweaks, export incentives, and compliance simplifications to offset US tariff risks and boost sectors like pharma, IT, and autos. This could enhance India's export competitiveness and integrate it deeper into global supply chains.

Market Impact and Investor Strategies

Stock markets are cautious ahead of the budget, with Nifty volatility amid FII outflows. Positive surprises in tax reforms or capex could trigger rallies in infra, defence, and manufacturing stocks. However, fiscal slippage risks might pressure bonds. Investors should track themes like railways, renewables, and MSMEs for opportunities.

Challenges and Broader Reforms

The budget must navigate global fragility, rupee pressures, and deposit challenges in banking. Reforms in GST, customs (GST-style overhaul), and faster tax dispute resolutions are anticipated. Employment incentives, including apprenticeships and MSME hiring subsidies, aim to address youth job gaps.

Conclusion: A Balanced Path to Viksit Bharat

Union Budget 2026 expectations center on continuity in capex, modest tax reliefs, and sectoral boosts to propel India toward Viksit Bharat by 2047. While no major fireworks are anticipated due to fiscal prudence, strategic measures could shield the economy from external shocks and foster inclusive growth. As FM Sitharaman tables the budget tomorrow, all eyes will be on how it balances ambition with realism. Stay tuned for live updates and post-budget analysis to see how these expectations unfold.

Frequently Asked Questions (FAQs)

1. When is the Union Budget 2026 being presented?

February 1, 2026, by Finance Minister Nirmala Sitharaman in Parliament.

2. Will there be big income tax cuts in Budget 2026?

Major slab changes are unlikely, but experts expect modest relief like a higher standard deduction (possibly ₹1-1.25 lakh), joint filing options for couples, and tweaks to capital gains tax or STT to benefit the middle class and investors.

3. What is the expected fiscal deficit target for FY27?

Around 4.3-4.4% of GDP, continuing the path of fiscal consolidation from 4.8% in FY26.

4. Will capex increase in Budget 2026?

Yes, most analysts predict capex rising to ₹11-12 lakh crore to support infrastructure, manufacturing, and growth.

5. Which sectors are likely to get the biggest boost?

Infrastructure (roads, railways), defence, green energy/renewables, manufacturing & MSMEs, agriculture (PM-KISAN, MSP), and digital/AI initiatives are expected to see strong allocations or incentives.

6. Will there be changes to LTCG or STCG tax rates?

There is demand to reduce LTCG from 12.5% to 5-10%, STCG from 20% to 10%, and restore indexation, but major cuts remain uncertain.

7. How might the budget impact the stock market?

Positive announcements on tax relief, capex, or sector incentives could spark rallies in infra, defence, railways, and green energy stocks. However, any fiscal slippage might lead to short-term volatility.

8. What about relief for senior citizens or home buyers?

Expectations include higher exemptions for seniors and possible revival of home loan interest deductions (up to ₹4 lakh) under the new tax regime.

Find the Best Mutual Funds for your every investment goal. Explore top mutual funds and start your SIP Today!

Find the Best Credit Card for your spending habits. Explore top credit cards and maximize your rewards.

Get a Personal Loan that fits your needs. Apply for loans from Rs 1000 to Rs 15 Lakhs with competitive rates.

Author - Abhishek Sonawane

Abhishek Sonawane, an MBA graduate from the prestigious Indian Institute of Management Visakhapatnam (IIMV), brings over ten years of experience in the finance domain. His extensive background includes various roles in financial management and strategy, providing him with a comprehensive understanding of the financial landscape. Abhishek’s expertise and dedication to financial education make him an authoritative voice in personal finance, helping readers make informed financial decisions.