Navigating Small- & Mid-Cap Stock Declines

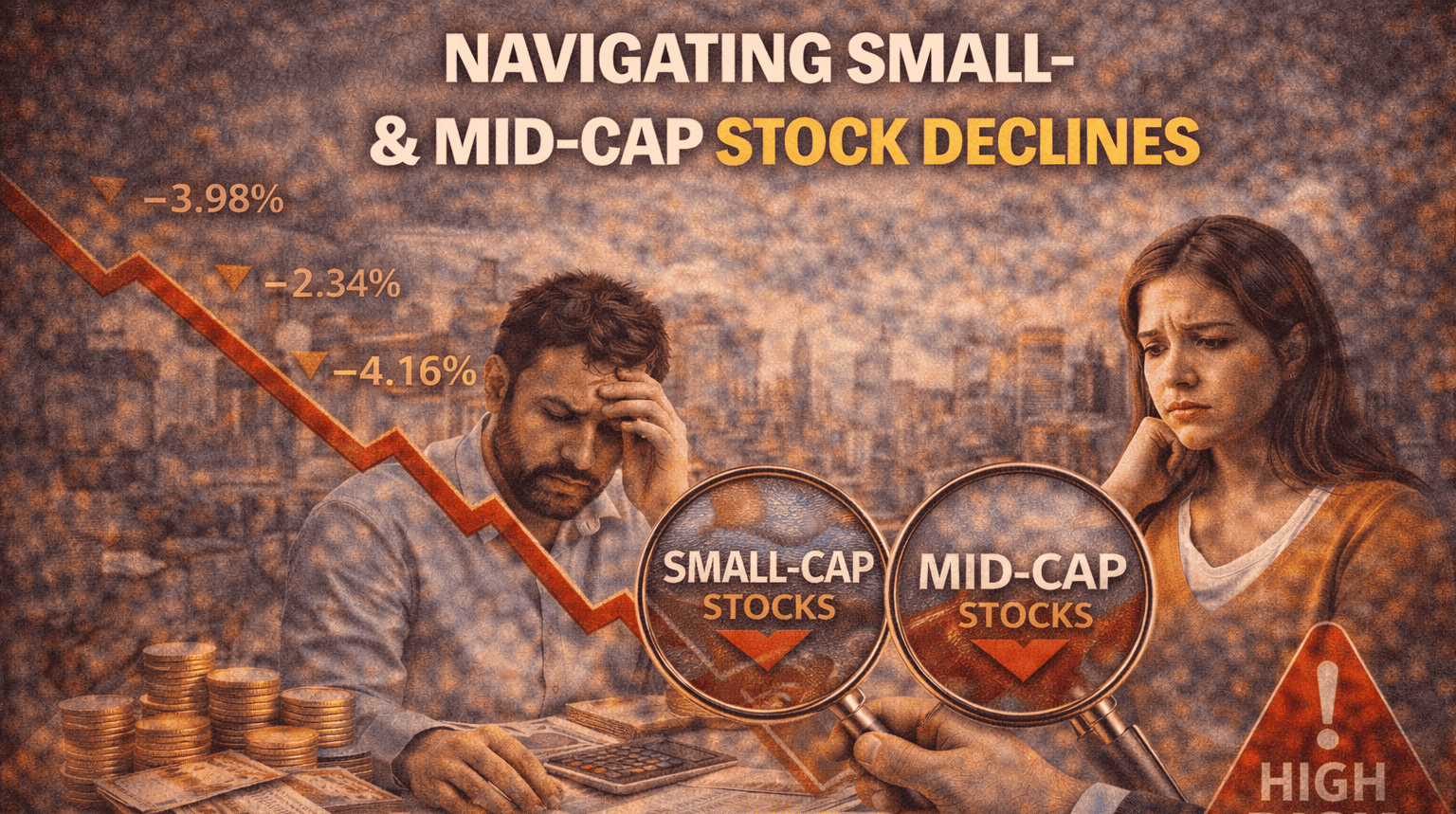

In recent months, small- and mid-cap stocks in India have faced significant selling pressure, raising concerns among investors. As of January 2026, the BSE Smallcap index has experienced a decline of about 7%, while the BSE Midcap index has fallen by 4%. This sharp drop can be attributed to ongoing worries over high valuations and disappointing quarterly earnings.

Market analysts point out that the trend of declining small- and mid-cap stocks began in early 2025. Despite a strong rally in these segments during the Covid period, the current environment is marked by caution as investors reassess their portfolios. The BSE Smallcap index has dropped from 51,525.46 points at the end of 2025 to 47,876.05 points by January 22, 2026.

Leading investment strategists like N Aruna Giri, CEO of TrustLine Holdings, note that many stocks have plummeted 40-50%. The dramatic shift in market sentiment is evident, as the small-cap index has been on a consistent downtrend since November 2025, with a staggering 7.5% drop recorded in January alone.

One of the primary reasons behind this sell-off is the stretched valuations that have plagued small and mid-cap stocks. After years of robust inflows and substantial gains, investor enthusiasm appears to have waned. V K Vijayakumar, Chief Investment Strategist at Geojit Investments Ltd, states that mid and small-cap stocks remain overvalued, leading to a cautious approach among investors.

While corporate earnings saw impressive growth during the pandemic, they have since dwindled, leading to reduced inflows into these stocks. In fact, earnings growth fell to just 5% in fiscal 2025, prompting many investors to exit their positions.

Given the current market conditions, experts advise a careful strategy. They suggest that while some opportunities may arise, the overall valuations of small and mid-cap stocks remain high compared to historical averages. Investors should avoid a ‘buy-on-dips’ mindset as further corrections could be on the horizon.

To navigate this challenging landscape, investors are encouraged to focus on stock-specific opportunities. Despite the overall bearish trend, there are still promising investments available for those willing to do their research and choose wisely.