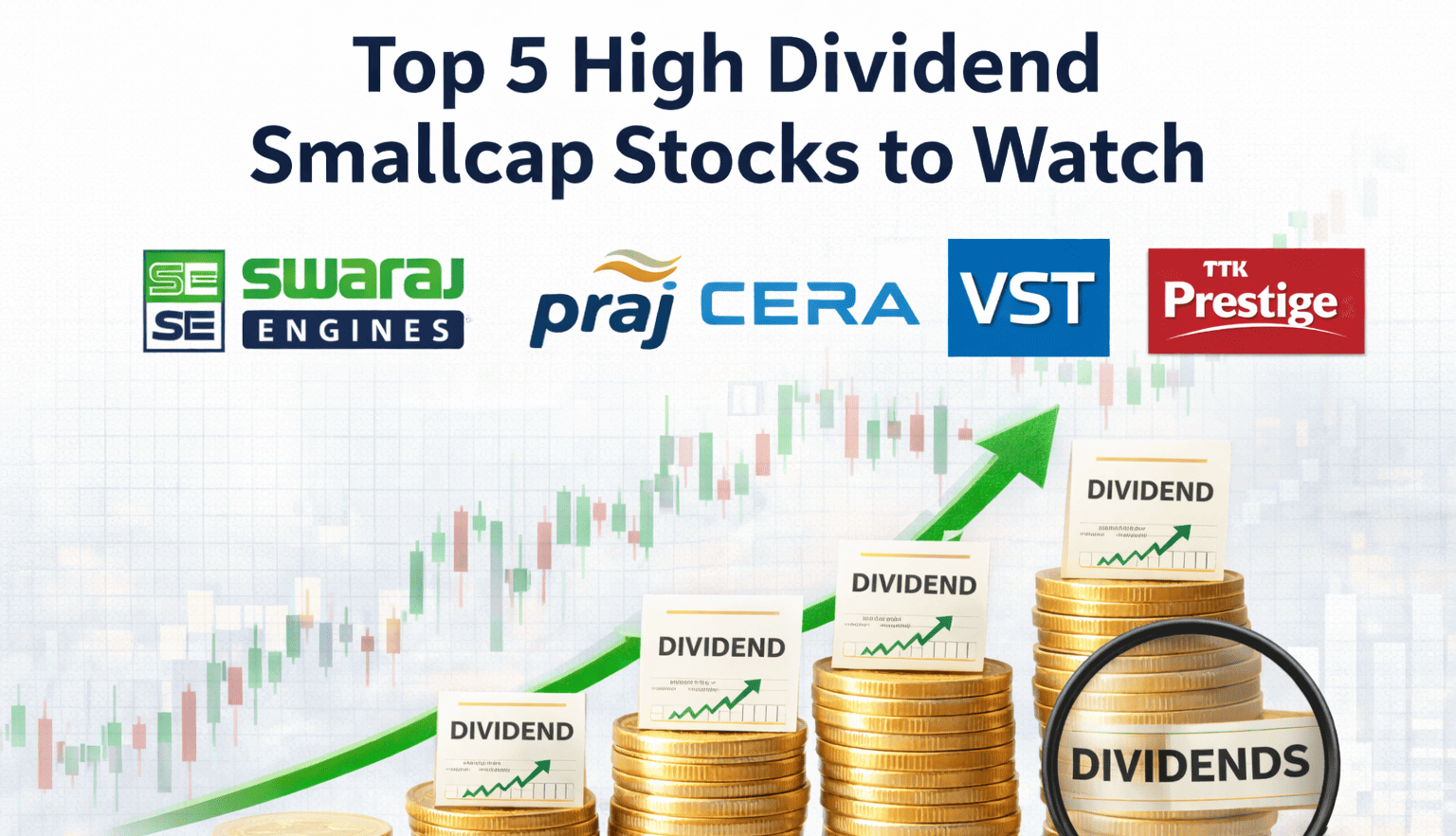

Top 5 High Dividend Smallcap Stocks to Watch

The Indian stock market has seen a significant decline in smallcap and midcap stocks over the past year and a half, creating fresh opportunities for income-focused investors. Amidst this correction, many fundamentally strong smallcap companies continue to generate cash and pay healthy dividends, indicating their resilience in challenging times.

Investors should consider looking for stocks with a history of regular payouts, as dividends can provide a steady stream of income when market conditions are unpredictable. Here are five smallcap dividend stocks to keep an eye on:

First on the list is Swaraj Engines, which supplies engines to Mahindra & Mahindra’s Swaraj division. With a consistent history of paying dividends, Swaraj Engines paid ₹105 per share in FY25. The company has seen robust growth, with sales and net profit rising at a CAGR of 17% and 19% over the past five years, benefiting from the increasing demand in the tractor industry.

Next is Praj Industries, a player in bioenergy and industrial wastewater treatment. Praj has consistently paid dividends, with ₹6 per share in FY25. It has recorded impressive growth rates, with sales and net profit growing at a CAGR of 21% and 26%, and has a strong international presence, making it a solid investment option.

Cera Sanitary, known for its sanitaryware and faucet products, ranks third. The company has a significant market share in India and has paid ₹65 per share in dividends for FY25. With a steady growth trajectory, Cera expects to outpace industry growth through product innovation and strong distribution channels.

VST Industries is fourth on the list, manufacturing cigarettes and tobacco products. Despite facing stagnant revenue, the company has paid dividends since 1997, with ₹30 per share in FY25. VST is focusing on sustainability and aims to incorporate renewable energy by 2030, making it an intriguing option for investors.

Lastly, TTK Prestige is a well-known kitchenware brand. The company has maintained consistent dividend payouts, paying ₹6 per share in FY25. Although recent profit figures have dipped, TTK is focused on product innovation to stay relevant in the market and continue expanding its business.

While smallcaps can be volatile, the potential for dividends combined with growth makes these stocks worth investigating. Investors should conduct thorough research and consider corporate governance and valuations before making decisions. Happy investing!